Salary slip is very important and necessary for employees doing personal work; However, some people ignore its importance. These documents detail wages, deductions and benefits, providing a clear income record. The ability to accurately interpret pay stubs is paramount for professionals in the workforce. This proficiency allows individuals to effectively manage their finances by meticulously tracking expenditures, validating disbursements, and facilitating the process of securing credit or loans.

What is a Payslip?

A payslip, often called a salary slip, is a formal document that a firm provides to its workers once a month. It provides a detailed breakdown of an employee’s salary and deductions for a specific pay period. The payslip can be sent to employees via mail or email. It is mandatory for companies to periodically issue payslips as proof of salary payments to employees and to show the deductions made.

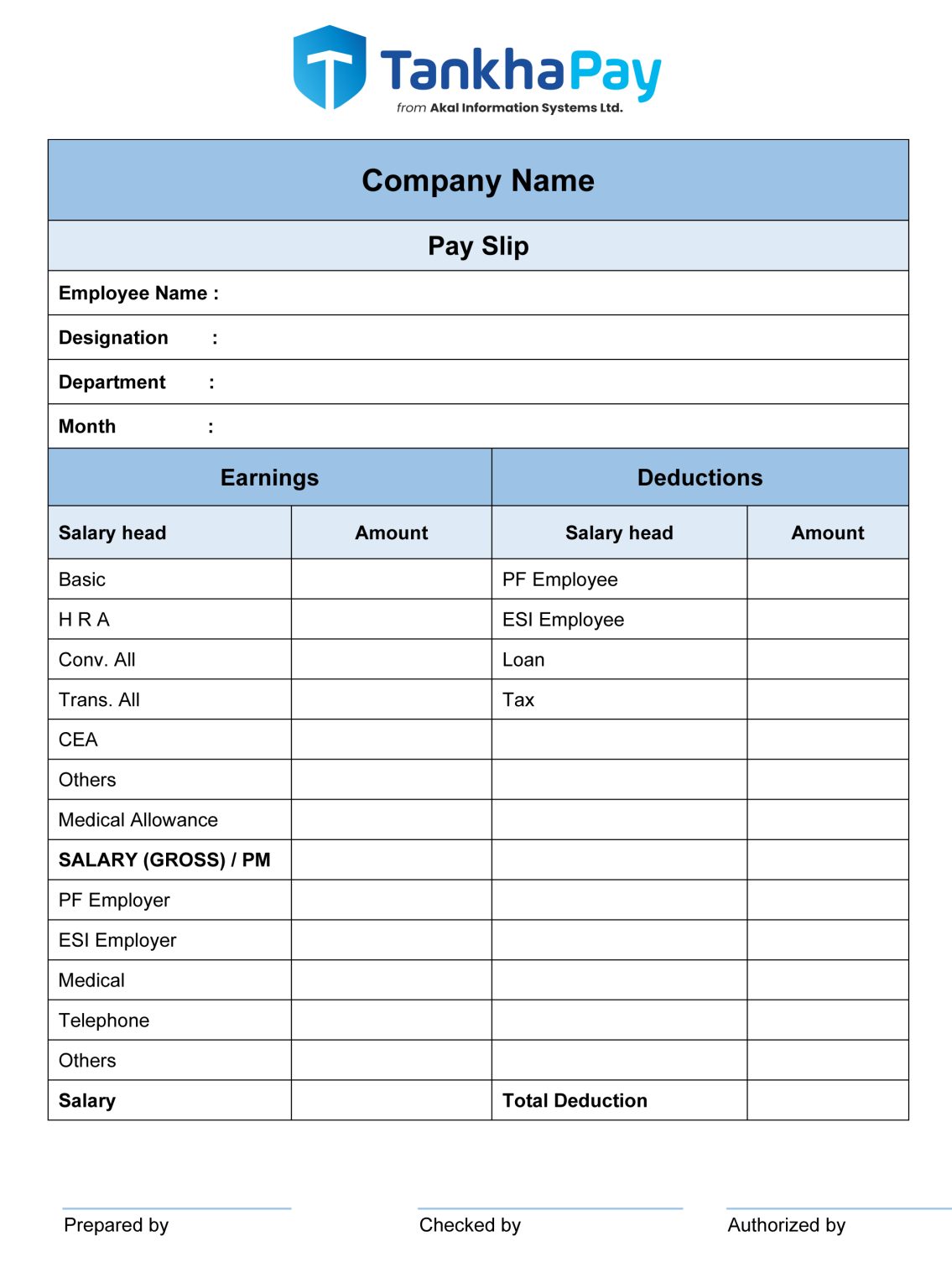

Considering creating payslips manually? UBS Payroll software provides the ability to automatically generate payslips. Employee salaries will be determined and paystubs will be generated and emailed to each employee’s email once a date has been selected. Each organization may have a different salary slip format. Below is a general salary slip format provided for better understanding.

Importance of a Salary Slip

If you are an HR Manager or an employer, you should create Employee Pay Slips at the end of each month.

Did you know that you can create employee salary slips online and customize them according to your business’s salary structure? Through the utilization of automated payroll management software, one can efficiently generate payslips for employees.

Is it possible to efficiently finalize your payroll with just a single click?

Salary Slip Format

The format of the monthly salary slip varies from company to company. However, a standard payslip format generally consists of the following details:

- Company logo, name, and address

- Month and year of the pay slip

- Employee code, name, designation, and department

- Employee’s PAN, Aadhar, and Bank Account Number

- EPF Account Number and UAN

- Working days of the month and leave taken

- Detailed list of income and deductions

This ensures compliance with the legal requirements of the Indian payroll administration system.

Salary Slip Components

Every month, employers generate salary slips that employees can download in PDF and other file formats.

- When seeking new employment opportunities, it is imperative to meticulously evaluate the available options.

- It is prudent to minimize tax liabilities by availing of all permissible deductions.

- It’s critical to identify the percentage of pay designated for mandated savings, including as contributions to the Employee Provident Fund (EPF), Employee Security Insurance (ESI), and other plans.

A pay slip format, commonly known as a pay slip, is a formal document that contains relevant details including business name, employee name, job title, working days, pay deductions and a unique employee code. .It carefully delineates two primary categories: income/earnings and deductions, providing a comprehensive overview of the individual’s remuneration components.

Income

This section of the pay stub lists the base pay and benefits. The details of each revenue component are discussed below.

Basic

As the name suggests, fundamental rights are fundamental. This is 35-50% of your salary. This serves as the basis for further payment components. The base is often higher at the lower level. As employees move up in the company, other benefits also increase. The first thing on the income side of your paycheck is the basics.

Dearness Allowance

One gets a Dearness Allowance to offset the impact of inflation on pay. Typically, it makes up 30–40% of base pay. DA is directly impacted by living expenses. Accordingly, it varies depending on the area. Both basic and DA are regarded as remuneration for income tax purposes. It shows up on the earnings side of the pay slip just after basic pay.

House Rent Allowance

Employees are entitled to House Rent Allowance (HRA) if they live in rented housing. HRA depends on where the employee lives. In big cities HRA is 50% of basic salary. In other cities it is 40% of the basic salary. House rent Allowance is a subsidy. So if an employee pays pension, he gets tax exemption up to a certain amount. It is included in the income column of your pay stub. HRA saves you income tax. In Chennai, Mumbai, Kolkata, or Delhi, the HRA amounts to 50% of (Basic + DA); for other cities, it is 40% of (Basic + DA).

Conveyance Allowance

Conveyance Allowance is the amount that an employer provides to cover the expenses of commuting to and from work. It is tax-free up to a specific amount since it is regarded as a concession. The earnings side of the pay stub shows this allowance. By receiving a conveyance allowance, one can avoid paying income tax. The exemption is the minimum of the following:

- INR 1600 per month

- Actual conveyance allowance received

Medical Allowance

A medical allowance is a sum of money that an employer gives an employee to cover his medical costs. Incurred during the course of their employment. This allowance provides the benefit of tax exemption; However, disbursement is dependent on the presentation of a certified document such as a medical bills.

In the absence of such documentation, the allowance becomes subject to full taxation. Notably, an amount of up to INR 15,000 is eligible for tax exclusion exclusively upon furnishing requisite documentation. Usually, the earnings part of the employee’s pay stub contains this information.

Leave Travel Allowance

Employers pay an employee’s travel expenditures (including those of their immediate family) throughout the term of their leave by providing a leave travel allowance (LTA). To receive the LTA discount, one must adhere to certain requirements by providing proof of travel.

The LTA tax exemption applies only to expenses directly related to transportation and does not cover any other additional costs incurred during travel. It’s crucial to remember that the exemption only applies to two trips made in a four-year span. You can find detailed information about the LTA in the earnings section of the salary slip.

Special Allowance in Salary

Performance-based compensation constitutes a type of special allowance provided to employees with the aim of incentivizing enhanced performance. These allowances, distinct within each organizational context, are fully subject to taxation. They are identifiable as components of the earnings section in the employee’s salary slip

Professional Tax

It is refundable in only a few states: West Bengal, Andhra Pradesh, Karnataka, Maharashtra, Tamil Nadu, Gujarat, Telangana, Chhattisgarh, Kerala, Assam, Orissa, Tripura, Meghalaya, Bihar, Jharkhand, and Madhya Pradesh.

Note that this amount applies to anyone who makes money through a medium, regardless of their level of experience. This deduction serves to reduce the taxable income and typically constitutes a nominal amount, usually in the range of a few hundred rupees per month, subject to taxation at the highest marginal rate. It is discernible in the deductions section of the salary slip.

Tax Deducted at Source

It depends on the employee’s gross tax bracket. Investing in tax-exempt securities like ELSS, PPF, NPS, and tax-saving FDs can reduce TDS. This amount can be seen on the salary slip. Investing in section 80C instruments under the Income Tax Act can increase take-home pay. Providing investment documentation to the employer and claiming TDS returns can also help.

Employee Provident Fund (EPF)

The Income Tax Act’s section 80C regulates the employee’s contribution to the provident fund. Managed by the Employees’ Provident Fund Organization, this fund is a way to build up retirement savings. Employers must additionally contribute a matching amount to their employees’ retirement benefits, and employees must contribute 12% of their base pay to the EPF.

The Employees’ Pension Scheme receives 8.33% of the employee’s contribution. A fixed payment of INR 1,250 is made if the monthly salary exceeds INR 15,000. The Employees’ Pension Scheme receives 8.33% of employees’ salaries under INR 15,000, with the remainder remaining in the EPF program. Employees have the option to forgo the EPF program (up to a certain point) and instead invest in products with potentially higher returns, such as equity funds (ELSS). The pay stub reflects the Employee Provident Fund under the deductions section.

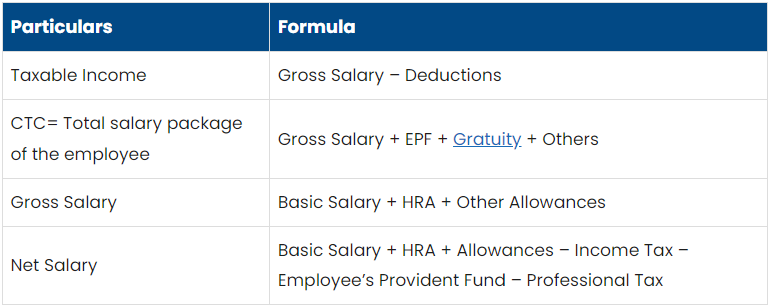

Formula of Salary Slip

Particulars Formulas

Taxable Income

Income (Gross Salary + Other Earnings) – Deductions

CTC (Total salary package of the employee) Gross Salary + PF + Gratuity

Gross Salary

Basic + HRA + Other Allowances

Net Salary

Basic + HRA + Allowances – Income Tax – Employer’s Provident Fund – Professional Tax

It is unnecessary to acquaint oneself with the formulas for calculating employee salaries, as the organization employs cloud-based payroll software.

Conclusion

Understanding a salary slip is crucial for both employers and employees. It details an employee’s income, deductions, and overall financial standing. Automated payroll systems can streamline the process and ensure accurate and timely distribution of payslips, improving compliance and employee satisfaction.

Visit More – Salary Increment – Definition, Factors, Importances, & Format