Medical insurance is a great form of planning for a medical emergency. It covers unplanned medical costs and even hospital bills if required. In India, most have no choice but to dip into their savings to cover medical bills. This often leads to amassing debts. To combat this, the government encourages people to have medical insurance by offering tax benefits through Section 80D of the Income Tax Act.

What is Section 80D?

Section 80D under the Income Tax Act avails tax exemptions from income tax on medical insurance premium payments and preventative health check-ups.

Eligible Payments under Section 80D

Section 80D of the Income Tax Act of 1961 allows tax deductions on the following:

- Premium payments towards medical insurance for spouse, dependent children, and parents

- Contribution to the Central Government Health Scheme

- Preventative health check-ups

- Medical expenses of senior citizens

The exemption amount depends on the payment method, the nature of the expenditure, and the age and relationship of the individual for whom the expenses are sustained.

Eligibility for Section 80D

Individuals or HUFs can claim benefits on the health insurance premium payments for the following:

- Self

- Spouse

- Dependent children and

- Parents

Deductions available under Section 80D

The following deductions are available under this section:

Deductions Under Section 80DD

Section 80DD allows an individual to avail up to Rs. 75.000 in tax exemptions on the medical costs of a disabled dependent. The tax exemptions can be up to Rs. 1,25,000 if the dependent has a severe disability (80% or above).

Medical treatment, nursing, training, rehabilitation and other medical expenses of a dependent with a disability can be claimed under Section 80DD. Dependents can either be the spouse, children, parents or siblings. However, an individual must submit a medical certificate issued by the central or state government’s medical board stating the dependent’s disability when filing income tax returns.

The certificate should mention the following:

- Name and age of the patient

- Nature and name of the ailment

- Name, address qualification and registration number of the doctor

- For cases where treatment is at a government hospital, the name and address of the Government hospital is needed

Deduction Under Section 80DDB

Section 80DDB allows an individual to claim up to Rs. 40,000 in tax exemptions on medical expenses sustained on treatment of specified diseases, including malignant cancers, AIDS, chronic renal failure, dementia and Parkinson’s Disease. The tax exemptions for senior citizens can be up to Rs. 1 lakh for treating specific ailments.

The nature of diseases and ailments for deduction under Section 80DDB are as follows :

- Neurological diseases as identified by a specialist wherein the percentage of disability certified has reached to 40 percent and more, including Dementia, Dystonia Musculorum Deformans, Chorea, Motor Neuron Disease, Ataxia, Aphasia, Parkinson’s disease, and Hemiballismus.

- Malignant Cancer

- AIDS- Acquired Immuno-Deficiency Syndrome

- Chronic Renal failure

- Hematological disorders such as Hemophilia or Thalassaemia.

People can also claim Section 80DDB deductions on the medical expenses sustained for the treatment of their spouse, parents, children, and siblings. However, proof of getting treatment for a specified disease has to be attached while filing income tax returns.

The certificate should mention the following :

- Name and age of the patient

- Nature and name of the ailment

- Name, address qualification and registration number of the specialist

- For cases where the treatment is given in a government hospital, the name and address of the Government hospital are needed

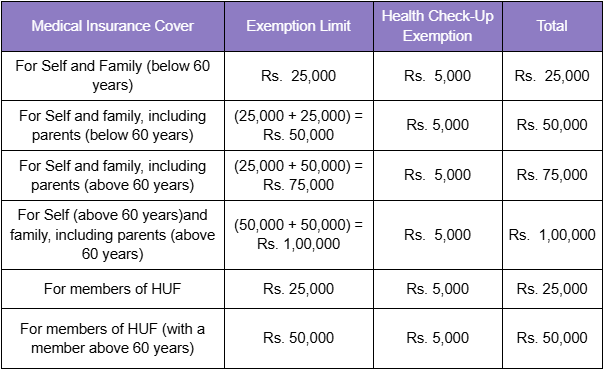

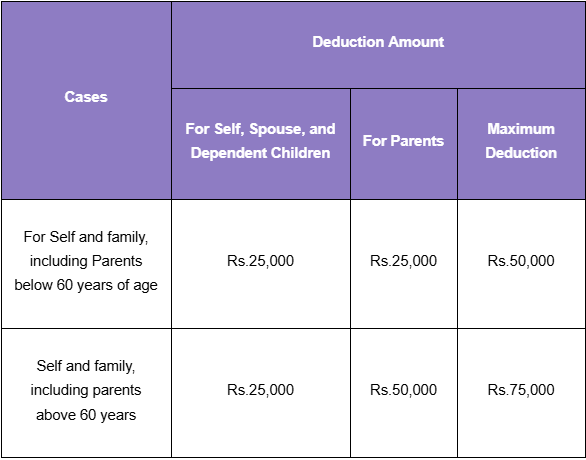

Deduction Limit under Section 80D

The deduction limits are as follows:

For example:

Ajay is 60 years old and is paying a yearly premium of Rs.32,000 for himself and his dependents. He also pays his parents a health insurance premium of Rs.35,000 (80 years old). As per Section 80D terms, he is eligible for:

- Tax deduction of Rs.32,000 on Rs.32,000 as a health insurance premium for Ajay and his dependents.

- Tax deduction of Rs.35,000 for his parents out of the overall payment of Rs.35,000.

- The total tax deduction that can be availed is Rs.67,000 out of the overall premium payment of Rs.67,000.

Deduction for Mediclaim under Section 80D

The deduction of Mediclaim under Section 80D happens so that an individual’s insurance policy stays active. This insurance can be for the individual or their spouse. Mediclaim is of utmost importance as it covers medical expenditure bills if someone falls ill and requires medical assistance.

Section 80D and 80C

Section 80D is often mistaken for Section 80C. While Section 80D focuses on tax benefits for health insurance premiums, Section 80C covers investments in financial instruments like small savings schemes and mutual funds. In contrast, Section 80D is meant exclusively for deductions on health insurance premiums paid.

Points to be Remember

The points to keep in mind are as follows:

- You cannot claim tax exemption under Section 80D if you pay the premium for your working children.

- You cannot claim tax deduction under Section 80D if you pay the premium for your siblings, grandparents, uncles, aunts, or other relatives.

- If you and your parents have partly paid your premiums, both can claim tax benefits under Section 80D.

- You cannot claim a tax deduction for the premium payment for a group medical health insurance.

- You must take the deduction without taking the service tax and cess portion from the premium amount.

Read Also – Why Payroll Management Is Crucial for Small Businesses